The Merrick bank credit card is an incredible option for those who are trying to build their credit histories. This card doubles the credit line of the individual’s account who has paid the minimum amount for the first seven months after opening the account. This means if you have opened the account with a credit line of $500 and if you can make seven on-time minimum payments, then you are eligible to increase the credit limit to $1000. This way you can lower your credit utilization and that will make a positive effect on your credit score. There is a one-time setup fee, which can amount up to $75, and an annual fee up to $96 is attached to the Merrick bank credit card. You will be charged up to $12 per additional card. Due to these additional costs, the credit card falls in the category of “fee harvesters” which are designed for customers with limited access to credit cards.

Positive aspects of the card

The best thing about the Merrick Bank credit card is that it helps you to improve your credit score. The card reports to the main credit bureaus like Experian, Equifax, and TransUnion and that is the reason why it allows you to build an incredible credit history. Due to this, you get approval for future financial products that you would want to avail of.

What is the initial credit limit of the card?

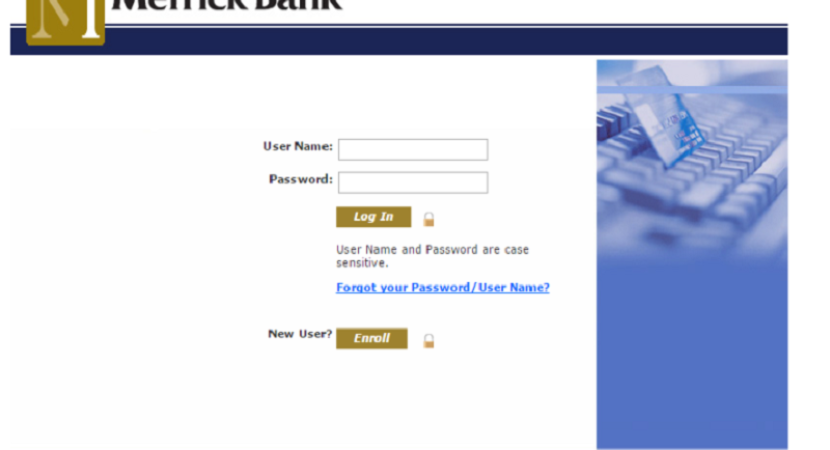

If you use the Merrick Bank Login to check the credit limit, you would get to know that the initial limit of the card lies between $550 to $1250. The credit line would automatically get doubled after 7 regular payments. An increased credit limit can be beneficial as it would help your credit utilization ratio and you would not have to worry about making out on your card’s limit. The percentage of your credit limits that you are using is your credit utilization ratio and it is one of the important factors that would determine your credit score. The only way to keep the credit utilization ratio low is by spending less on the card.

Benefits of the card

- Merrick bank credit card applicationis a very easy process. Once you show interest, the representatives of the bank would get in touch with you and deliver the card after perusing all the formalities.

- Merrick bank credit card customer service is great. The cardholder can anytime bother them for any type of inquiries. You can even call them up for reporting stolen or lost cards.

- If your card is misplaced, you get an emergency card replacement service and emergency cash disbursement.

- There is a zero liability policy that comes with this credit card.

- You will get an updated FICO score for free with the card. The mobile app of the Merrick bank card can be accessed for more convenience.

The final verdict

The Merrick Bank has over three million credit cardholders. However, it is suitable mainly for individuals who are interested in building or rebuilding their credit. That implies that Credit cards like Merrick bank are designed for individuals who have credit ranging from bad to fair and are consistently seeking ways to improve it. No security deposit is required to maintain the card. If you are eager to make significant progress on your financial standing, then this card would be your ultimate option.

Merrick bank credit card is an unsecured card; however, it is worth taking a look. It is one of those cards that can increase your credit limit and prove to be beneficial in upgrading your financial basics.

Reply